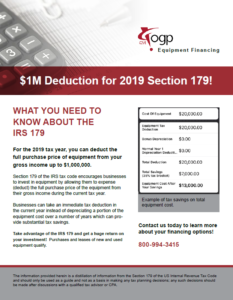

For the 2019 tax year, you can deduct the full purchase price of equipment from your gross income up to $1,000,000. This makes now the perfect time to invest in new capital equipment!

Section 179 of the IRS tax code encourages businesses to invest in equipment by allowing them to expense (deduct) the full purchase price of the equipment from their gross income during the current tax year. Businesses can take an immediate tax deduction in the current year instead of depreciating a portion of the equipment cost over a number of years which can provide substantial tax savings.

Click on the PDF to see the savings calculator or click below to request a quote.

Take advantage of the IRS 179 and get a huge return on your investment!

Latest Cross Company Updates

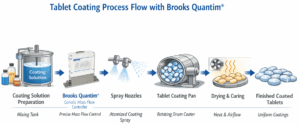

Brooks Instrument Application – Quantim® QMC coriolis flow meter improves pharmaceutical tablet coating uniformity, achieves precise low-flow control, and reduces waste.

January 13, 2026

Transform point clouds into actionable data. Learn how mesh generation improves CAD comparison, reverse engineering, and GD&T inspection.

January 7, 2026

Maximize profitability in casting. This guide from Kreon explores how 3D scanning digitizes parts, reduces waste, and ensures strict QC compliance. Learn More!

January 7, 2026

Learn when to use touch probes vs 3D scanners. Discover applications for disc, star, and hemispherical styli for complex part inspection.

January 7, 2026